StratAgree™ – Customer Lifetime Value

To make better marketing decisions, you have to know the value of customer relationships.

Most banks, credit unions and insurance organizations have at least a fair idea of what a customer relationship is worth, right? Well, probably not as many as you might think. Often, an organization’s perception of customer value is limited to an annual accounting of income vs. expense. Further, when it comes to justifying marketing investment, there is a tendency to view customer value in light of only the products being promoted.

Many organizations have fairly sophisticated systems to measure direct revenue and expense and to allocate indirect costs to products. These are great but often do not help leadership determine how and how much to invest in marketing. In order to know whether or not to spend money marketing or otherwise trying to acquire customers, we really need to have a better handle on the benefits of having customers in the first place.

StratCLV™ Customer Lifetime Value tool

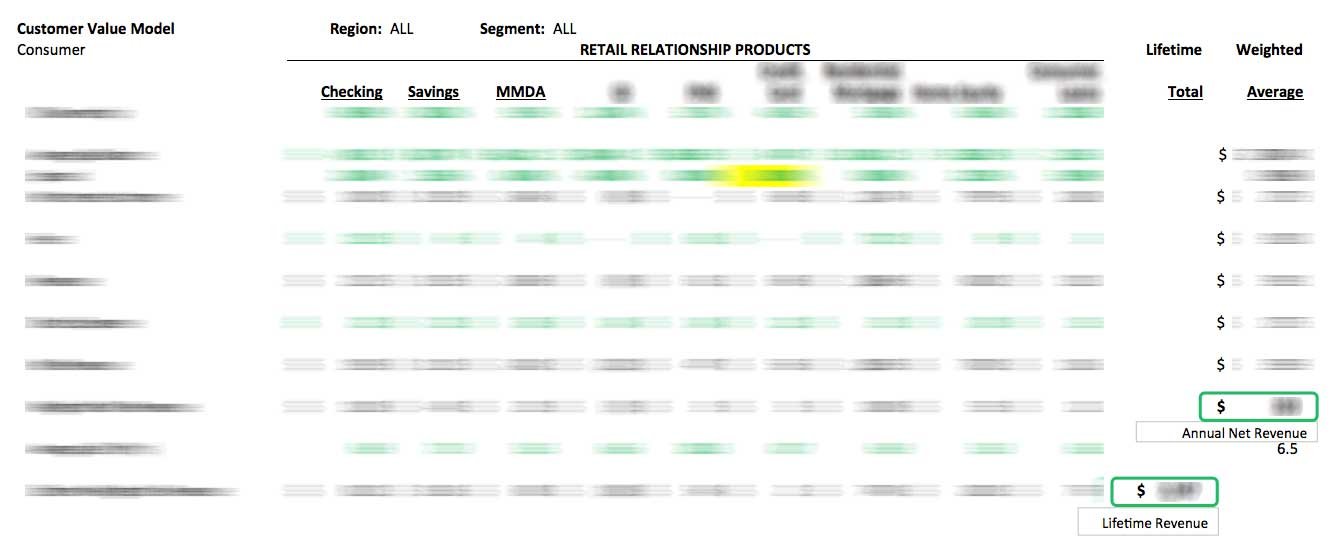

StratAgree has developed a solution for this need and we call it StratCLV™. Our analytic framework clearly measures all facets of a customer relationship and leverages data about product ownership, funds transfer pricing, income and expense and other factors to create an aggregate view of both annual and lifetime value. Further, with StratCLV™, you will have accurate customer valuations by region, by segment and by tenure.

Make more informed decisions on where to promote, what to promote, how much to invest and more when you know the true value of customer relationships.

To learn more, contact Robert Dorn at 404-987-2419.